Term sheet vs SAFE

last updated: Sep 6, 2025

TL;DR

Use a SAFE for speed and lower legal cost. Use a term sheet when you need price, board, and rights now. Model dilution first.

How to:

How to:

- Map the goal and runway. Pick SAFE for speed or priced round for structure. If your offer is fuzzy, tighten your value proposition and revisit product positioning so investors can assess fit fast.

- Run dilution math for both. Include option pool and all SAFEs.

- Close on the least-risk path. Solve the next 12 months.

Glossary

SAFE: Simple Agreement for Future Equity that converts later.

Post-money SAFE: Cap is post-money; investor percent at conversion is investment ÷ cap, making dilution easier to model.

Term sheet: Offer on a priced equity round with key terms listed.

Cap: Valuation ceiling used for SAFE conversion math.

Discount: % reduction vs priced round per share price at conversion.

MFN: “Most favored nation.” Future better terms flow back to you.

Pro rata right: Right to buy more shares to keep your percent.

Protective provisions: Investor veto rights on key actions.

Option pool: Shares reserved for hires. Dilutes all.

409A valuation: Fair-market value used to price options.

Post-money SAFE: Cap is post-money; investor percent at conversion is investment ÷ cap, making dilution easier to model.

Term sheet: Offer on a priced equity round with key terms listed.

Cap: Valuation ceiling used for SAFE conversion math.

Discount: % reduction vs priced round per share price at conversion.

MFN: “Most favored nation.” Future better terms flow back to you.

Pro rata right: Right to buy more shares to keep your percent.

Protective provisions: Investor veto rights on key actions.

Option pool: Shares reserved for hires. Dilutes all.

409A valuation: Fair-market value used to price options.

How to choose investment tool for a startup

- Decide the job to be done. If you need cash fast with minimal paper, use a SAFE. If you need a board seat, governance, and a visible valuation, run a priced round with a term sheet.

- Model both paths. List current fully diluted shares. Add planned option pool. Add each SAFE with its cap and discount. Model a priced round at your target pre-money.

- Check control. Do you need a formal board, information rights, and protective provisions now? If yes, use a term sheet.

- Price-signal. Decide if you want a public valuation today. SAFEs avoid pricing for now. A term sheet sets it and affects 409A valuation.

- Pick cap table tools. Use any spreadsheet or a tool to test scenarios. Capture ownership after conversion and after new money.

- Choose investor mix. If you have a lead and can close in 4-12 weeks, a term sheet works. If you have many small checks and momentum, pick SAFEs and roll closings.

- Paper it. Use the YC SAFE documents and the YC post-money SAFE primer for clean templates. For priced rounds, start from the NVCA model term sheet. For background and pitfalls, see Cooley GO on SAFEs.

- Close and communicate. Confirm board approvals where needed. Send a post-close update with the plan to the next milestone.

Benchmarks

Short notes

- SAFEs are best for speed. Priced rounds are best for structure and shared expectations. See Carta pre vs post-money SAFEs for conversion mechanics.

- Option pool size often becomes a lever. Larger pool pre-money increases effective dilution. See the Carta option pool guide.

Sample math.

Assumes no discounts/MFN; caps only.

Scenario A. You raise $1.2m using three post-money SAFEs capped at $12m. The group owns 10% post-SAFE by definition. Later you raise $4m at a $24m pre-money. Everyone, including the 10%, dilutes by the new $4m on $24m. For more detail, read Cooley GO with notes/SAFEs math.

Assumes no discounts/MFN; caps only.

Scenario B. You raise $1.2m as a priced seed at $12m pre-money with a 15% pool added pre-money. New investors own 9.1% ($1.2m on $13.2m). Founders and early holders absorb both the investor percent and the pool. Compare both scenarios before you sign.

Assumes no discounts/MFN; caps only.

Scenario A. You raise $1.2m using three post-money SAFEs capped at $12m. The group owns 10% post-SAFE by definition. Later you raise $4m at a $24m pre-money. Everyone, including the 10%, dilutes by the new $4m on $24m. For more detail, read Cooley GO with notes/SAFEs math.

Assumes no discounts/MFN; caps only.

Scenario B. You raise $1.2m as a priced seed at $12m pre-money with a 15% pool added pre-money. New investors own 9.1% ($1.2m on $13.2m). Founders and early holders absorb both the investor percent and the pool. Compare both scenarios before you sign.

In 90 seconds, find the bottleneck stopping your first 10 customers. Take the free quiz and get a personalized action plan.

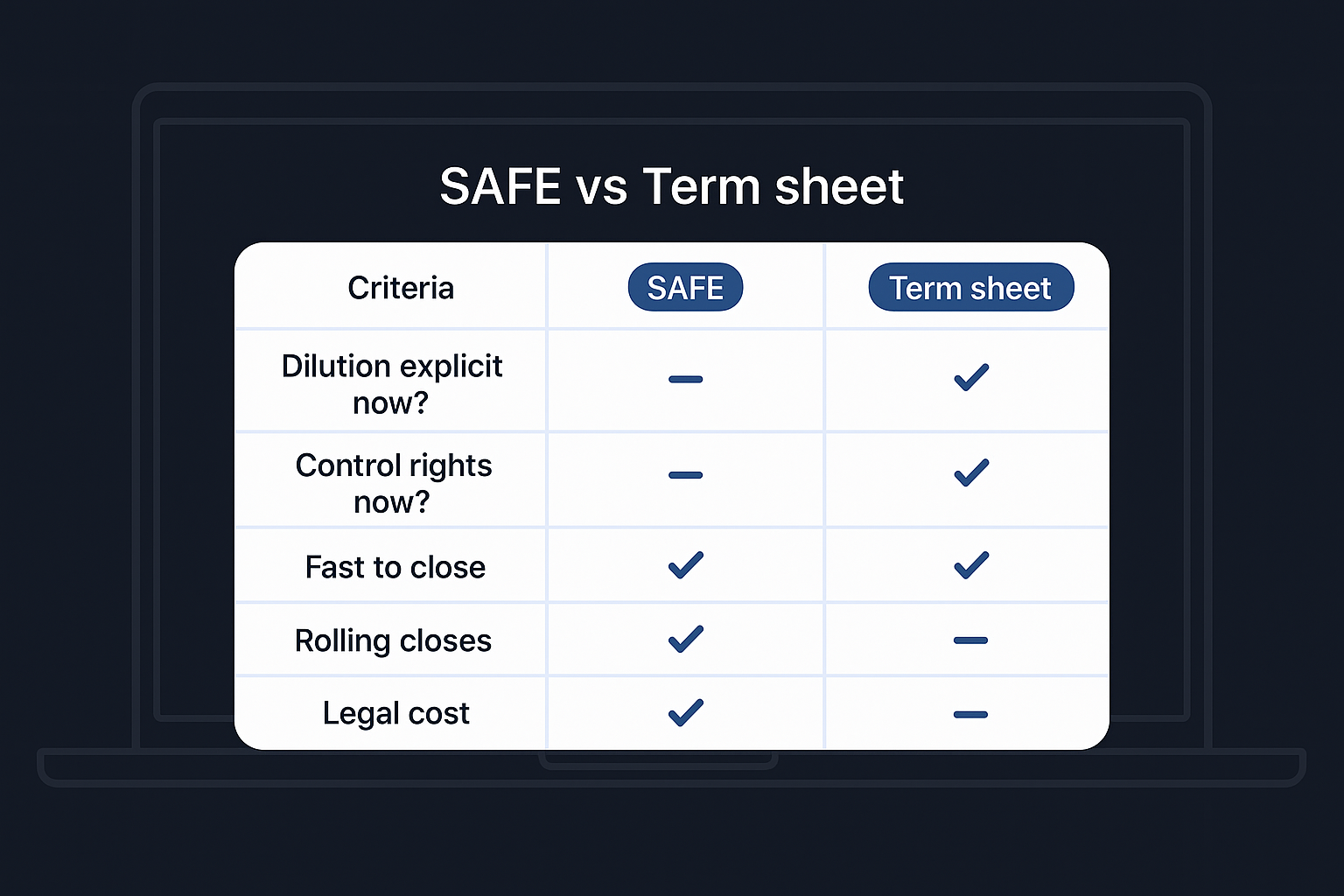

Term sheet vs SAFE direct comparison

When to use which

Pros and cons

SAFE

Term sheet

- Pick a SAFE when speed, simplicity, and many small checks matter.

- Pick a term sheet when you have a lead, need a board now, or want a market valuation on record.

Pros and cons

SAFE

- Pros: fast. cheap. rolling closes. common at pre-seed and seed.

- Cons: dilution can be underestimated. Pro rata/MFN may appear via side letters; large SAFE stacks can chill leads.

Term sheet

- Pros: clear price and percent today. formal rights. cleaner cap table later.

- Cons: slower. more legal work. needs a lead and coordination.

Templates

Comparison checklist

Cap table impact mini-sheet

Inputs: FD shares. Pool target. SAFE stack. Priced pre-money and new money.

Outputs: ownership after SAFEs and after priced round. Investor rights triggered.

Founder email to an angel (example)

Subject: Quick SAFE at $10m post cap

Hi {First name},

We are closing a small SAFE now to extend runway to 12 months. Terms: $10m post-money cap. No discount. No MFN. No pro rata. Target close next week. Happy to share metrics and plan.

Best,

<You>

Board consent one-liner (example)

“The Board approves the issuance of SAFEs substantially in the form circulated, with an aggregate cap of $1.5m and a post-money valuation cap of $12m.”

- Round goal and runway need defined.

- Instrument picked: SAFE or priced.

- If SAFE: cap, discount, MFN, valuation type set. Side letters listed.

- If priced: board, protective provisions, information rights, option pool size.

- Cap table modeled under 3 scenarios.

- Counsel engaged and budget approved.

- Closing tasks owner and date.

Cap table impact mini-sheet

Inputs: FD shares. Pool target. SAFE stack. Priced pre-money and new money.

Outputs: ownership after SAFEs and after priced round. Investor rights triggered.

Founder email to an angel (example)

Subject: Quick SAFE at $10m post cap

Hi {First name},

We are closing a small SAFE now to extend runway to 12 months. Terms: $10m post-money cap. No discount. No MFN. No pro rata. Target close next week. Happy to share metrics and plan.

Best,

<You>

Board consent one-liner (example)

“The Board approves the issuance of SAFEs substantially in the form circulated, with an aggregate cap of $1.5m and a post-money valuation cap of $12m.”

Risks

- Stacking too many SAFEs. Leads may balk later. Fix by setting a hard cap and communicating.

- Hidden side letters. Track all rights in one log. Share with counsel.

- Pool top-up shock. Model 10-20% pool pre-money for the priced round.

- Pricing too soon. A weak price can haunt future rounds. Wait if you can grow into it.

- Pricing too late. Big SAFE stacks reduce founder percent more than you think.

- Mixed SAFE terms across investors. Fix: standardize form and keep a single “rights log” shared with counsel.

FAQ

- You:Is a SAFE debt?Guide:No. It is not debt and has no interest.

- You:Do SAFEs need a board vote?Guide:Often yes in practice. Get a consent for clarity and good hygiene.

- You:What cap and discount are normal?Guide:Caps vary by stage and market. Early seed may see single-digit millions. Later seed higher. Discounts of 10-20% are common when used.

- You:Can I stack multiple SAFEs?Guide:Yes. But use one template and consistent terms. Keep a clean log.

- You:Do I need a lead investor?Guide:For SAFEs, not always. For priced rounds, almost always.

- You:How does pro rata work?Guide:It gives an investor the right to buy more to keep their percent. It is standard in priced rounds and rare by default in SAFEs unless you add a side letter.

- You:Will SAFEs change my 409A valuation?Guide:Large SAFE rounds can affect the fair market value. Ask your 409A provider.

- You:What happens if the company is acquired before a priced round?Guide:SAFEs have clauses for liquidity events. Investors may get cash back or equity per the form.

- You:Do I need a lawyer?Guide:Yes. This is not legal advice. Have counsel review terms and any side letters.

Ready to stop guessing?

© 2025

If you're a founder who needs to pick the right financial instrument fast,